Congress pushing forward with legislation to address the unexpected bills

Arundi Venkayya

Curator of EngagingPatients.org

Surprise medical bills are top of mind for patients and lawmakers, as is the desire to prevent them.

Medical billing is a complicated, complex process with hundreds of thousands of codes, reimbursement protocols and players. For the average patient, it can be overwhelming to receive four, six or even more medical bills after what seemed like a short stay at a healthcare facility.

What is a surprise medical bill?

According to the Kaiser Family Foundation, a surprise medical bill is a “bill from an out-of-network provider that was not expected by the patient or that came from an out-of-network provider not chosen by the patient.” Kaiser Family Foundation polling indicates that two-thirds of Americans are either “very worried” or “somewhat worried” about being able to afford their or a family member’s unexpected medical bill, should they receive one.

There are two kinds of surprise medical bills:

- The patient has to pay more than they expected to because services received were out-of-network.

- An out-of-network physician or other provider “balance bills” the patient to recoup the difference between the amount the provider charged and the amount insurance is willing to pay.

According to the Kaiser findings, three-fourths of the public want the federal government to take action to protect patients from covering the cost of care when:

- They are taken to an emergency room by an out-of-network ambulance;

- They are taken to an out-of-network emergency room during a medical emergency; and/or

- They are treated by an out-of-network specialist at an in-network hospital.

What is being done to address surprise medical bills?

Thirteen states have enacted laws to address surprise medical billing: California, Connecticut, Florida, Illinois, Maryland, New Hampshire, New Jersey, New York and Oregon. New Mexico, Washington, Colorado and Texas have not yet implemented their laws that were passed earlier this year.

In addition to state-level movements to end surprise medical bills, Congress also is working on legislation that would end the practice of surprise billing. Although there is broad support for the idea, the specifics of legislation are still being debated — including how to resolve payment questions.

So far, state approaches have varied. Some have established a payment standard. Others are using a dispute-resolution process that can lead to arbitration. Some are using a combination of these approaches.

The same debate is happening at the federal level. An early draft of legislation being considered in the Senate had three options for dispute resolution:

- An in-network guarantee

- Baseball-style arbitration

- Benchmarking

Benchmarking is what made it into the final draft, which recently was approved by the Senate Health, Education, Labor and Pensions Committee. Benchmarking means the insurer pays the provider a “median in-network rate” (i.e., a rate comparable to that of other providers in the same area).

There continues to be debate on both sides. Some hospital and physician groups want to pursue negotiation and are opposed to the fixed payment standard. Meanwhile, some health insurers and employer groups support a federal payment standard as a simpler and less expensive approach.

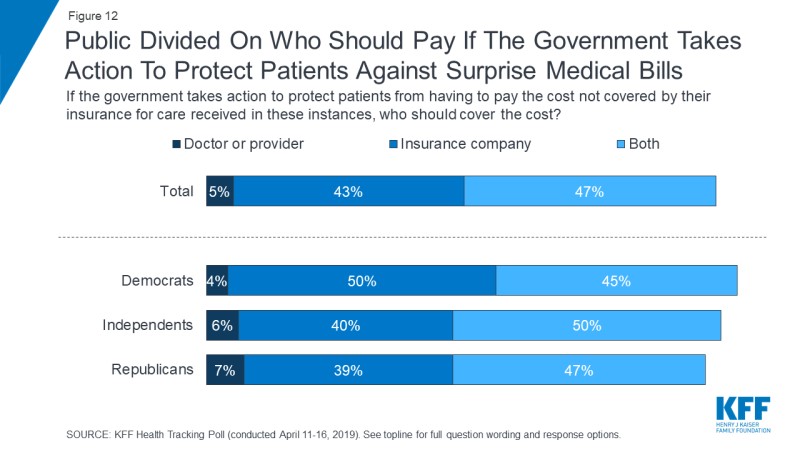

The public also is divided on who should pay, according to the Kaiser research. One thing is clear, though; patients do not want to responsible for these bills any longer.